本次會(huì)議,美聯(lián)儲(chǔ)保持利率水平不變。

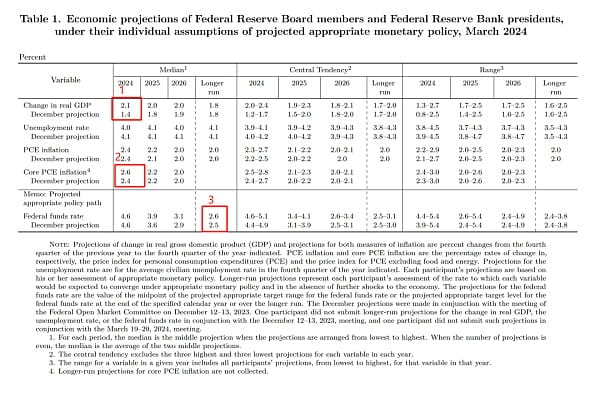

會(huì)議公布了新的經(jīng)濟(jì)預(yù)測(cè),上調(diào)了對(duì)本年度的GDP增長(zhǎng)預(yù)測(cè)與通脹預(yù)測(cè)。

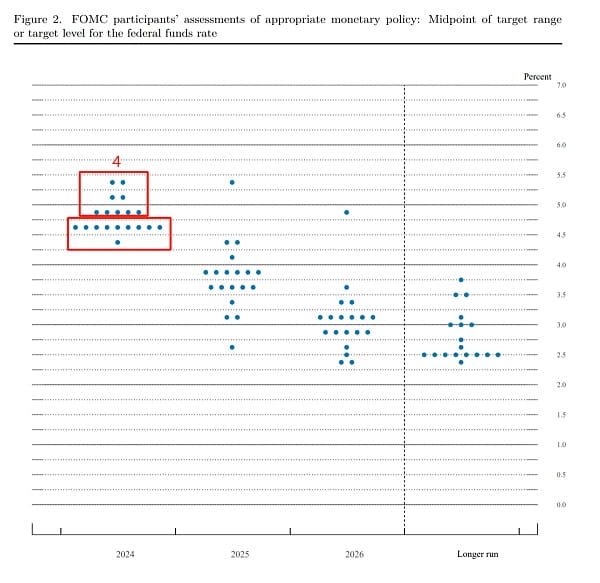

點(diǎn)陣圖變化焦灼,預(yù)計(jì)2024年降息3次(10位委員),未來(lái)兩年的降息次數(shù)亦下降,但符合預(yù)期。

發(fā)布會(huì)鮑威爾重申本輪周期利率已經(jīng)觸頂,確認(rèn)了在今年啟動(dòng)降息是合適的。

1月和2月的CPI數(shù)據(jù)并未改變鮑威爾對(duì)去通脹進(jìn)程的樂(lè)觀態(tài)度,他強(qiáng)調(diào)FOMC本就預(yù)期通脹回落不會(huì)一帆風(fēng)順(bumpy)。

對(duì)就業(yè)市場(chǎng)的強(qiáng)勢(shì)表現(xiàn),鮑威爾顯得“毫無(wú)保留”,并強(qiáng)調(diào)就業(yè)過(guò)強(qiáng)不會(huì)影響降息決定。

有關(guān)長(zhǎng)期利率預(yù)測(cè)近5年內(nèi)的首次上行,鮑威爾表態(tài)“不知道具體水平在哪”但不會(huì)像疫情前那么低了。

對(duì)于QT Taper,聯(lián)儲(chǔ)已經(jīng)開(kāi)始討論資產(chǎn)負(fù)債表的結(jié)構(gòu)問(wèn)題,鮑威爾強(qiáng)調(diào)了流動(dòng)性的“分布”問(wèn)題。

從觀感上看,本次會(huì)議幾乎沒(méi)有展露出任何的鷹派信號(hào),市場(chǎng)在會(huì)議前所擔(dān)憂的二次通脹風(fēng)險(xiǎn)并未進(jìn)入FOMC的視野。

筆者認(rèn)為聯(lián)儲(chǔ)在開(kāi)年會(huì)議上奠定的“風(fēng)險(xiǎn)管理”和“平衡風(fēng)險(xiǎn)”的姿態(tài)在本次會(huì)議上出現(xiàn)了bias,淡化了通脹風(fēng)險(xiǎn),深化了對(duì)增長(zhǎng)的樂(lè)觀預(yù)期。

風(fēng)險(xiǎn)資產(chǎn)持續(xù)走高,10年期美債收益率沖高回落,美元跌。

經(jīng)濟(jì)預(yù)測(cè)上調(diào),這都快跟高盛(樂(lè)觀派)的預(yù)測(cè)差不多了

通脹預(yù)測(cè)小幅上調(diào),體現(xiàn)去通脹并非坦途。

長(zhǎng)期利率預(yù)測(cè)小幅上升10bp,疫情以來(lái)的首次。

從點(diǎn)陣圖來(lái)看,實(shí)際上認(rèn)為降息兩次內(nèi)的委員是9位,而認(rèn)為降息兩次以上的為10位,降息次數(shù)有進(jìn)一步調(diào)降的風(fēng)險(xiǎn)。

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.

最近的指標(biāo)表明經(jīng)濟(jì)活動(dòng)以穩(wěn)健的速度擴(kuò)張。就業(yè)增長(zhǎng)保持強(qiáng)勁,失業(yè)率保持低位。通脹在過(guò)去一年有所放緩,但仍然居高不下。

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

委員會(huì)致力于實(shí)現(xiàn)在長(zhǎng)期內(nèi)充分就業(yè)和2%的通脹率。委員會(huì)認(rèn)為實(shí)現(xiàn)就業(yè)和通脹目標(biāo)的風(fēng)險(xiǎn)正在朝著更好的平衡方向發(fā)展。經(jīng)濟(jì)前景不確定,委員會(huì)對(duì)通脹風(fēng)險(xiǎn)保持高度關(guān)注。

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

為了支持其目標(biāo),委員會(huì)決定將聯(lián)邦基金利率的目標(biāo)區(qū)間維持在5.25%至5.5%之間。在考慮對(duì)聯(lián)邦基金利率目標(biāo)區(qū)間進(jìn)行任何調(diào)整時(shí),委員會(huì)將仔細(xì)評(píng)估最新數(shù)據(jù)、不斷變化的前景和風(fēng)險(xiǎn)平衡。委員會(huì)預(yù)計(jì)在獲得更大信心,即通脹朝著2%的可持續(xù)增長(zhǎng)方向發(fā)展之前,降低目標(biāo)區(qū)間將不合適。此外,委員會(huì)將繼續(xù)按照其先前公布的計(jì)劃減持國(guó)債、機(jī)構(gòu)債務(wù)和機(jī)構(gòu)抵押支持證券。委員會(huì)堅(jiān)決致力于將通脹恢復(fù)到2%的目標(biāo)水平。

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

在評(píng)估貨幣政策的適當(dāng)立場(chǎng)時(shí),委員會(huì)將繼續(xù)監(jiān)測(cè)經(jīng)濟(jì)前景的相關(guān)信息。如果出現(xiàn)可能阻礙委員會(huì)目標(biāo)實(shí)現(xiàn)的風(fēng)險(xiǎn),委員會(huì)將準(zhǔn)備適時(shí)調(diào)整貨幣政策的立場(chǎng)。委員會(huì)的評(píng)估將考慮到廣泛的信息,包括勞動(dòng)力市場(chǎng)狀況、通脹壓力和通脹預(yù)期以及金融和國(guó)際發(fā)展情況。

相關(guān)閱讀推薦

最新資訊

最新游戲

王國(guó)保衛(wèi)戰(zhàn)之前線中文版

查看

人氣王漫畫(huà)社

查看

只是游樂(lè)場(chǎng)最新版

查看

前線裝甲部隊(duì)與將軍

查看

恐怖躲貓貓5官網(wǎng)版

查看

超級(jí)救火隊(duì)(Sprinkle Islands)

查看

3D駕駛課2025

查看

光榮束縛

查看

街頭角斗士2聯(lián)機(jī)版

查看熱門(mén)文章

熱門(mén)游戲

公主懷孕生娃娃

查看

多玩爐石盒子手機(jī)版

查看

飛機(jī)駕駛模擬器手機(jī)版

查看

富豪莊園最新版app

查看

方塊人大亂斗游戲

查看

仙境傳說(shuō)之復(fù)興手游

查看

雷電模擬器游戲中心app(雷電游戲中心)

查看

我的咖啡廳無(wú)限鉆石版 v20.7.0破解版

查看

絕地吃雞最新版 v1.1.0中文版

查看

風(fēng)之劍舞安卓版 v.1.0.3

查看

風(fēng)之劍舞官方版 v.1.0.6

查看

忍者快跑破解版 v.2.0.0內(nèi)購(gòu)版

查看

戰(zhàn)國(guó)之刃手機(jī)版 v1.34官網(wǎng)版

查看

純?nèi)龂?guó)

查看

莽荒紀(jì)手游官方版 1.2.4最新版

查看

像素世界2021最新版

查看

火柴人對(duì)決無(wú)廣告版 v2.4.5手機(jī)版

查看

老爹熱狗店手機(jī)版

查看